Eb5 Immigrant Investor Program for Dummies

Eb5 Immigrant Investor Program for Dummies

Blog Article

Eb5 Immigrant Investor Program - Questions

Table of ContentsEb5 Immigrant Investor Program Can Be Fun For EveryoneThe Greatest Guide To Eb5 Immigrant Investor ProgramThe Facts About Eb5 Immigrant Investor Program UncoveredThe Only Guide for Eb5 Immigrant Investor ProgramUnknown Facts About Eb5 Immigrant Investor ProgramEb5 Immigrant Investor Program Can Be Fun For Anyone

The even more information clarifying your company, the much more likely you are to be thought about as having a detailed and legitimate organization for an investor visa in the USA., at Scott D. Pollock & Associates have over 30 combined years of experience in migration law.

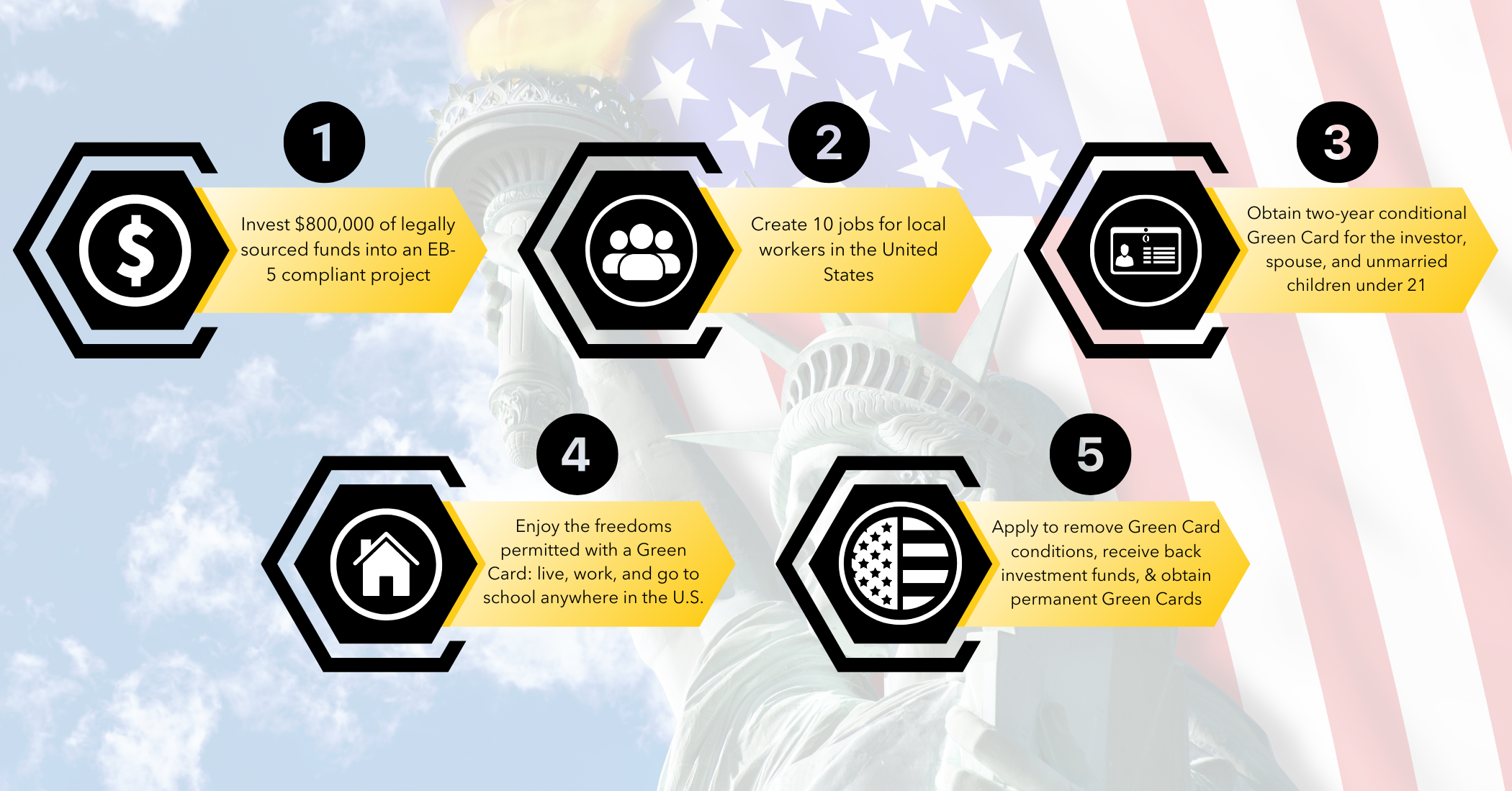

Citizenship, via financial investment. Currently, as of March 15, 2022, the amount of investment is $800,000 (in Targeted Employment Areas and Rural Areas) and $1,050,000 in other places (non-TEA areas). Congress has actually accepted these amounts for the next five years starting March 15, 2022.

Entrepreneurs and immigrants developed the USA of America. Integrating concepts with strategy, phenomenal ability, and a substantial amount of resources can pave the means to the American dream and authorized long-term house in the US. EB5 Immigrant Investor Program. Administered by the United States Citizenship and Immigration Solutions (USCIS), the EB-5 financier visa program enables international financiers the possibility to purchase and carry out business in the United States while getting approved for permits on their own and their family participants

Some Of Eb5 Immigrant Investor Program

The needed investment differs depending on whether they are investing in rural locations or high-unemployment locations. The funds for the financial investment need to come from a reputable source. The financial investment needs to either be in a brand-new commercial venture or investing in an existing business enterprise.

Eb5 Immigrant Investor Program - The Facts

The visa candidate should be legitimately admissible to the United States, be at least 18 years old, intend to take up legal irreversible home in the US, and satisfy the lawful meaning of a recognized financier. Targeted employment areas are geographical locations with an unemployment rate of a minimum of 150% of the nationwide standard at the time of the application and financial investment.

As soon as the financier proves the high joblessness criterion, they may receive a smaller financial investment, according to migration law. High joblessness rates can be collected either through public documents or by obtaining a letter from a certified state government agency. One more means to identify a TEA is if it is taken into consideration a backwoods.

If you meet every one of the demands for the EB-5 financier program, you may be qualified to obtain an environment-friendly card (legal copyright card). You will certainly receive a conditional house permit at first, and afterwards you will require to prove to the federal government that you have upheld your end of the deal with your financial investment and request for the federal government to here eliminate problems so that you can get a permanent permit.

Eb5 Immigrant Investor Program Fundamentals Explained

We check your financial investment and job production progress to make certain conformity with EB-5 demands during the conditional duration. We assist collect the required documentation to show that the needed investment and work development requirements have been fulfilled.

Prior to the pandemic, USCIS reported an average handling time of 14.2 months for EB-5 requests. USCIS in 2024 is refining EB-5 applications more info faster than in current years. USCIS has implemented different actions to improve the performance and timeliness of the EB-5 adjudication procedure.

Under the Biden administration, which is typically much more immigration-friendly, there are assumptions of boosted processing times. Secretary of Homeland Protection Alejandro Mayorkas, that previously led USCIS, is expected to add to these enhancements. In addition, during the 2008 economic crisis, EB-5 played a significant duty in financial healing, showing government support for the program throughout the existing financial rebound.

Top Guidelines Of Eb5 Immigrant Investor Program

Congress has set assumptions for USCIS to achieve processing times of no more than 6 months and to accumulate fees sufficient to meet this target. In recap, these actions and reforms show USCIS's devotion to boosting handling times for EB-5 applications and supplying much more reliable services to investors. The opportunities of success in the EB-5 program can differ based upon different factors.

The Permit will be energetic for 2 years, up until problems are removed. Submit Kind I-829 after 1 year and 9 months to get rid of problems on irreversible residency. Review a detailed summary of the EB-5 procedure. When it pertains to determining where to invest and finding suitable EB-5 projects, there are a couple of opportunities to consider.

This allows them to examine the job firsthand, consult here with the designer and management group, and make an educated financial investment decision. On the other hand, collaborating with a broker dealer agent provides financiers with a more comprehensive choice of financial investment alternatives. The due diligence process is typically conducted at the EB-5 Funds' expenditure, relieving investors of this responsibility.

, it indicates that the project is considered to offer an urgent federal government or public rate of interest. In some situations, we have actually observed that financiers in expedited projects have received approval in much less than 6 months, or even significantly quicker.

Some Ideas on Eb5 Immigrant Investor Program You Should Know

Financiers must maintain a detailed method to due persistance and extensively evaluate the investment task, despite its expedited status. In the realm of EB-5 investments, most of investments are structured to meet the requirements of a Targeted Employment Area (TEA). By locating the financial investment in a TEA, financiers end up being qualified for the lower investment threshold, which currently stands at $800,000. Buying a TEA not only allows investors to make a reduced capital investment but likewise gives a new course of visas that have no waiting line, and investments into a rural area receive priority handling.

These non-TEA projects might supply various investment chances and job types, providing to investors with differing preferences and purposes. Eventually, the choice to invest in a TEA or non-TEA job depends on a person's economic abilities, investment goals, risk resistance, and positioning with their personal preferences.

Report this page